Introduction

Tokenization is transforming the world of finance—turning real-world assets like stocks, bonds, real estate, and commodities into programmable digital securities. By 2025, Ethereum has emerged as the backbone for this new wave, making security tokens more accessible, transparent, and efficient than ever before. This blog explores how Ethereum is powering institutional adoption, what’s driving the surge in security tokens, and how technical advances and regulatory clarity are unlocking trillion-dollar opportunities for businesses, investors, and fintech innovators.

Data Analytics in Banking: Transforming Finance in 2025

What Is Tokenization, and Why Does It Matter in 2025?

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. With security tokens, these digital assets follow strict legal and regulatory frameworks, combining blockchain transparency with the safeguards of traditional finance.

-

Why it matters:

-

Improved liquidity & 24/7 trading

-

Fractional ownership and instant settlement

-

Lower transaction costs and fewer intermediaries

-

Greater transparency and auditability

-

Improved access for global retail and institutional investors

-

Key Trends Shaping Ethereum Tokenization

1. Regulatory Clarity and Institutional Adoption

-

Security tokens are no longer experimental. As of 2025, global regulators have established clear frameworks for tokenized securities, enabling traditional banks, asset managers, and major trading platforms to enter the space confidently.

-

Major institutions are deploying capital at scale and demanding industrial-strength tokenization platforms.

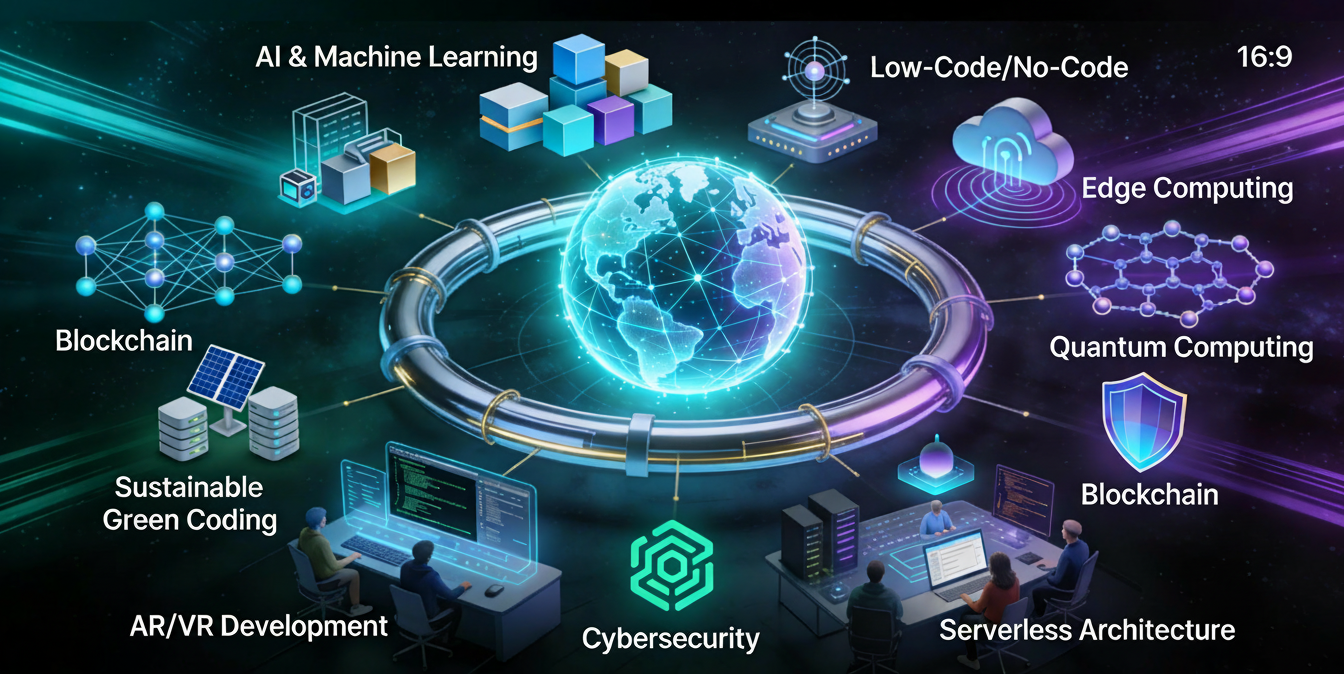

2. Ethereum: The Platform of Choice

-

Mature Standards: ERC-3643 and ERC-1400, designed specifically for compliance and transfer restrictions, are widely used for security token management.

-

On-Chain Compliance: Automation of KYC/AML and transfer validations through smart contracts.

-

Interoperability: Seamless integration with DeFi, Layer-2 solutions, other blockchains, and real-world financial infrastructure.

3. Growing Tokenization Use Cases

-

Tokenized Treasuries: Over $24 billion in real-world assets (RWAs) are already tokenized—including U.S. Treasuries (the largest category), real estate, and private equity.

-

New Asset Categories: Equity, credit funds, and even IP rights are joining the tokenized economy.

-

Programmable Compliance: Smart contracts automate rule enforcement, dividend payouts, voting, and more.

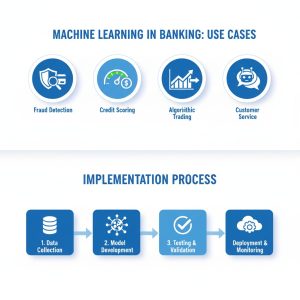

How Security Tokens Work on Ethereum

-

Asset Selection: Real-world asset (e.g., stock, real estate) is chosen for tokenization.

-

Token Standardization: Security tokens are created using ERC-3643, ERC-1400, or ERC-1404—which enforce compliance and transfer rules at the smart contract level.

-

Custody & Compliance: Assets are held by licensed custodians. On-chain KYC/AML controls who can hold or trade tokens.

-

Issuance & Trading: Tokens are issued, managed, and traded digitally on compliant exchanges and marketplaces—enabling instant, global liquidity.

-

Reporting & Analytics: Immutable audit logs, real-time reporting, privacy features (with zero-knowledge proofs), and AI-powered anomaly detection.

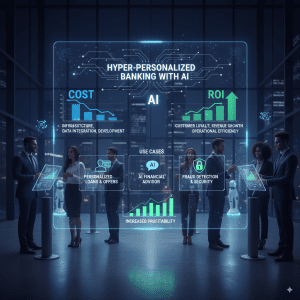

Benefits of Ethereum-Powered Tokenization

-

Efficiency: Near-instant settlement, automated compliance, and fewer intermediaries cut costs and speed up processes.

-

Transparency: Blockchain’s auditability reduces fraud, manual errors, and regulatory risk.

-

Programmability: Automated dividends, voting, or redemption logic embedded in smart contracts.

-

Accessibility: Fractional ownership democratizes investment in previously illiquid or exclusive asset classes.

Challenges and What’s Ahead

-

Scalability: Layer-2s and rollups address throughput and cost concerns.

-

Privacy & Security: Zero-knowledge cryptography and robust custody solutions balance transparency with confidentiality.

-

Interoperability: Bridges, modular architectures, and evolving standards let tokens move across platforms and chains.

-

Market Education: As the benefits become clearer, financial institutions, governments, and investors are accelerating adoption.

Real-World Examples Making Waves

-

Apollo Global’s On-Chain Credit Fund: Tokenized funds operational on Ethereum.

-

Robinhood & eToro: Offering tokenized equity in private companies exclusively on Ethereum.

-

Major Banks & Agencies: Adopting tokenization for bonds, funds, and supply chain finance.

Conclusion

Ethereum tokenization in 2025 is ushering in an era where security tokens are foundational to the next generation of capital markets. Backed by regulatory clarity, technical maturity, and rising institutional demand, Ethereum is enabling programmable, borderless, and transparent assets that redefine access to investment and unlock new models for global finance.

Ready to harness blockchain for financial innovation?

Discover tailored tokenization, smart contract, and decentralized finance solutions for your enterprise at TechOTD, or explore AI-powered smart contract analytics and integration with TechOTD AI, custom development services, and more.

FAQ

1. What are security tokens?

Security tokens are digital representations of ownership in assets like stocks, funds, or real estate, issued and traded on blockchain networks under regulatory compliance.

2. Why is Ethereum preferred for tokenization?

Ethereum offers mature standards (ERC-3643, ERC-1400), programmable compliance, a vibrant DeFi ecosystem, and proven reliability.

3. What assets are being tokenized in 2025?

U.S. Treasuries, real estate, private equity, credit funds, and even intellectual property rights.

4. How does compliance work on-chain?

Smart contracts automate transfer restrictions, KYC/AML, cap tables, and reporting, with audit trails and privacy layers.

5. Can retail investors participate?

Yes, as regulatory clarity spreads, access is broadening—fractional ownership opens doors to global retail and institutional investors.