Introduction

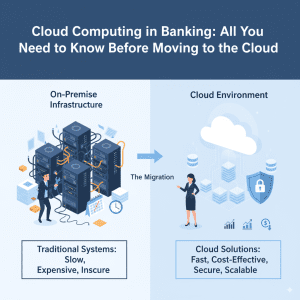

The banking industry is undergoing a profound digital transformation, with cloud computing emerging as a critical enabler of innovation, agility, and operational efficiency. Banks worldwide are rapidly adopting cloud technologies to modernize legacy systems, enhance customer experience, and accelerate product delivery. However, migrating to the cloud also presents unique challenges around data security, regulatory compliance, and integration complexity.

This blog covers everything banks need to know before moving to the cloud—benefits, risks, migration strategies, and key considerations for a successful cloud journey. It also highlights how AI-driven cloud solutions and predictive analytics are shaping the future of banking technology, drawing on insights from leading experts like TechOTD.

Why Cloud Computing Matters for Banks

-

Scalability: Cloud platforms enable banks to scale computing resources on demand during peak loads or new product launches.

-

Cost Efficiency: Moving from capital expenditure to operational expenditure reduces upfront IT investments and optimizes resource usage.

-

Innovation Enablement: Cloud supports rapid development of digital banking products, AI-powered services, and personalized customer experiences.

-

Improved Collaboration: Cloud platforms enhance data sharing across departments and partner ecosystems securely.

-

Disaster Recovery & Business Continuity: Cloud’s resilient infrastructure safeguards critical banking operations against data loss and outages.

Explore how AI and analytics complement cloud capabilities to drive smarter, data-driven banking:

Predictive Analytics in Banking.

Key Considerations Before Moving to the Cloud

1. Regulatory Compliance and Data Privacy

Banks must comply with strict regulations like GDPR, PCI DSS, and regional data protection laws. Understanding cloud providers’ compliance certifications and data residency options is vital.

2. Security and Risk Management

Implementing end-to-end encryption, identity and access management (IAM), and continuous threat monitoring is mandatory to protect sensitive financial data.

3. Legacy System Integration

Seamless integration between existing on-premises systems and cloud platforms is crucial to avoid business disruptions.

4. Selecting the Right Cloud Model

-

Public Cloud: Cost-effective and scalable but requires strict security controls.

-

Private Cloud: Offers better control and security but at higher costs.

-

Hybrid Cloud: Combines benefits of both, allowing sensitive workloads on private clouds and less critical ones on public clouds.

5. Vendor Lock-in and Multi-cloud Strategy

Banks should evaluate risks associated with dependence on a single cloud provider and consider multi-cloud approaches for flexibility and resilience.

Migration Strategies for Banking Cloud Adoption

-

Lift and Shift: Moving applications without changes; fastest but may not optimize cloud benefits.

-

Re-platforming: Modifying existing apps for cloud compatibility and efficiency.

-

Refactoring: Redesigning applications entirely to be cloud-native, maximizing scalability and functionality.

TechOTD’s expert teams design and execute tailored cloud migration strategies ensuring minimal disruption:

How We Work – TechOTD.

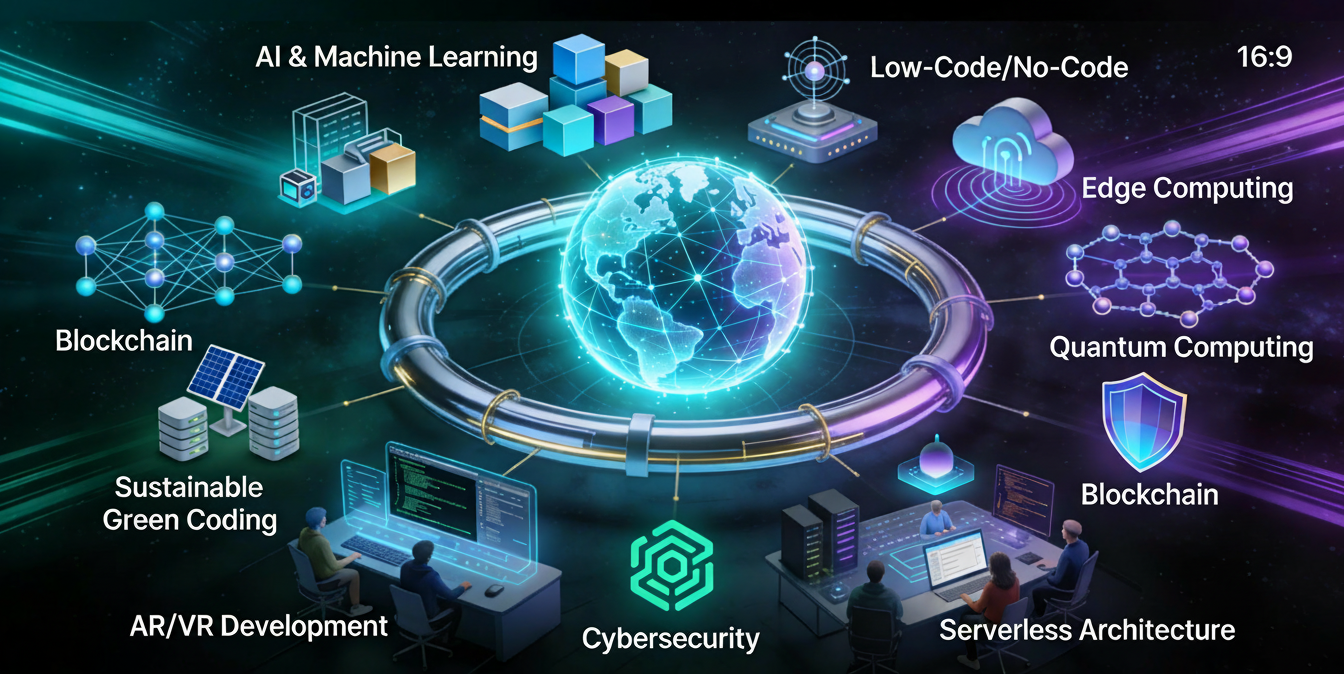

Benefits of AI and Cloud in Modern Banking

-

Enhanced Fraud Detection: AI algorithms analyze transactions in real-time to flag suspicious activities.

-

Personalized Customer Experiences: AI models predict customer needs and tailor financial products.

-

Operational Efficiency: Automation reduces manual workflows and error rates.

Discover AI’s role in banking innovation and see real-world examples:

Large Language Models in Finance.

Challenges Banks Face in Cloud Adoption

-

Managing cultural and organizational change

-

Ensuring interoperability across hybrid environments

-

Handling complex data migration and synchronization

-

Meeting constantly evolving compliance and security requirements

Conclusion

Cloud computing offers transformative potential for banks looking to innovate, scale, and compete in the digital economy. However, it requires careful planning, strategic decision-making, and trusted technology partnerships to effectively manage risks and unlock benefits. Leveraging AI and predictive analytics atop cloud infrastructure further accelerates banking digital maturity by enabling smarter operations and customer-first models.

Embark on your cloud journey with experienced partners like TechOTD, who specialize in AI-driven cloud solutions for finance and beyond.

Explore more banking technology insights and trends at TechOTD Blog.

FAQs

Q1: Is public cloud safe for banks?

With strong encryption and compliance controls, public cloud can be secure, though sensitive data may benefit from private or hybrid clouds.

Q2: How long does cloud migration usually take?

Depending on scale and complexity, it ranges from a few months to over a year.

Q3: What are key benefits of hybrid cloud in banking?

It balances security, flexibility, and cost efficiency by allocating workloads appropriately.

Q4: Can AI operate effectively in cloud environments?

Yes, cloud provides the computational power and scalability AI applications demand.

Q5: How to avoid vendor lock-in?

Adopt open standards, multi-cloud strategies, and platform-agnostic architectures.