Introduction

In 2025, data analytics has become the backbone of innovation and efficiency in fintech enterprises. Whether it’s for risk assessment, real-time fraud detection, customer personalization, or regulatory compliance, the strategic use of big data is redefining how fintech firms operate and scale. In this blog, we’ll explore how data analytics functions in the fintech sector, covering everything from data collection and processing to predictive modeling and business impact. Plus, discover why working with a future-ready partner like TechOTD is key to accelerating your fintech transformation journey.

The Role of Data Analytics in Fintech

1. Data Collection & Integration

Fintech companies ingest massive volumes of structured and unstructured data from banking transactions, payment gateways, customer interactions, IoT devices, and open banking APIs. The data stack typically involves cloud-native data lakes, robust ETL pipelines, and seamless integrations—often built by expert partners like TechOTD Web Development Services.

2. Preprocessing & Cleaning

Before analysis, raw data undergoes cleaning, transformation, and normalization. This ensures that only accurate, relevant, and consistent information is carried forward. Automated workflows powered by AI-driven process monitoring and automation can catch anomalies and flag low-quality data early.

3. Real-Time Analysis & Decisioning

Modern fintech relies on real-time analytics. Platforms stream data through tools like Apache Kafka or cloud-native systems, enabling instantaneous fraud detection, payment authorization, and compliance monitoring. For high-volume actions such as microtransactions or trading, milliseconds matter.

4. Predictive Modeling & Machine Learning

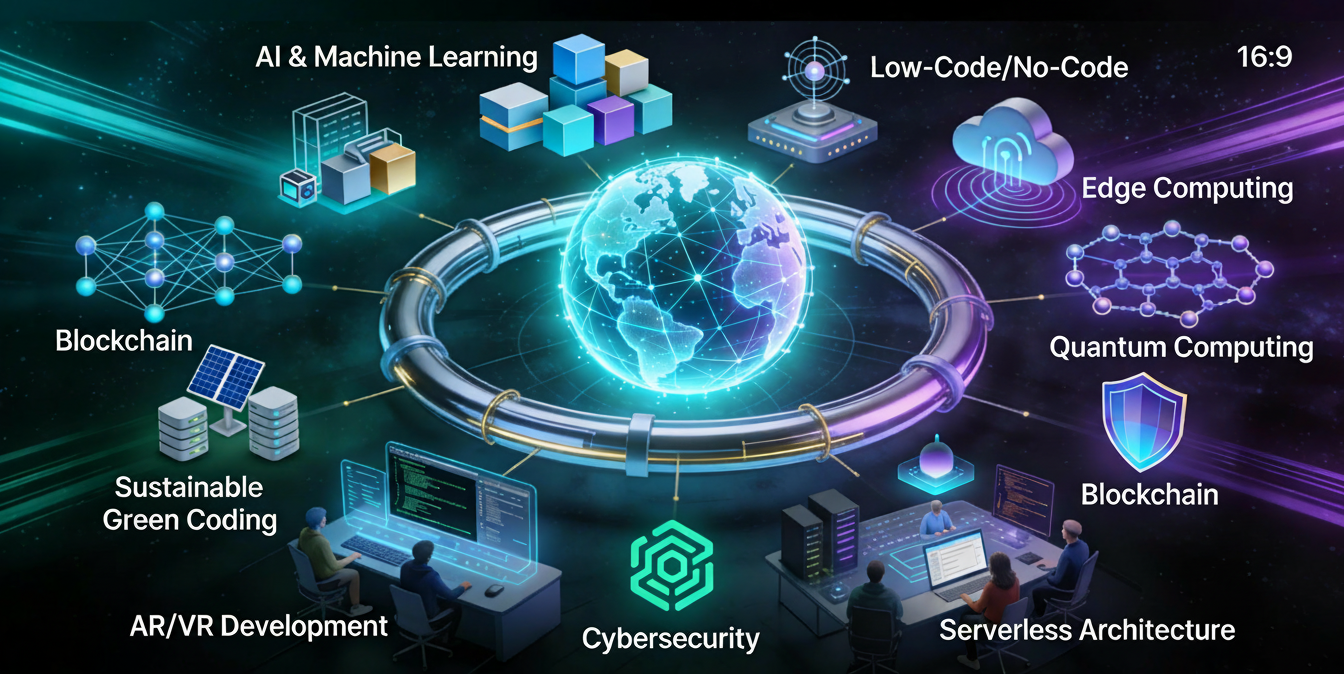

At the core of fintech analytics are advanced AI and machine learning models that power:

-

Credit scoring & risk assessment

-

Fraud pattern recognition

-

Customer segmentation & personalization

-

Predictive portfolio management

-

Dynamic pricing for loans and insurance

AI models are developed, trained, and deployed by specialists using platforms and stacks like those offered by TechOTD’s AI Solutions, which also include model retraining and ongoing performance refinement.

5. Visualization & Business Insights

Clear data visualization—think dashboards, interactive charts, automated reports—makes complex analytics understandable, actionable, and auditable for decision-makers, regulators, and partners.

6. Compliance & Data Security

Regulations in finance are strict (GDPR, PSD2, local compliance). Data analytics platforms in fintech must be secure, transparent, and auditable, using encrypted flows, monitored access, and traceable changes. TechOTD’s consulting and development services include robust compliance planning baked into every solution.

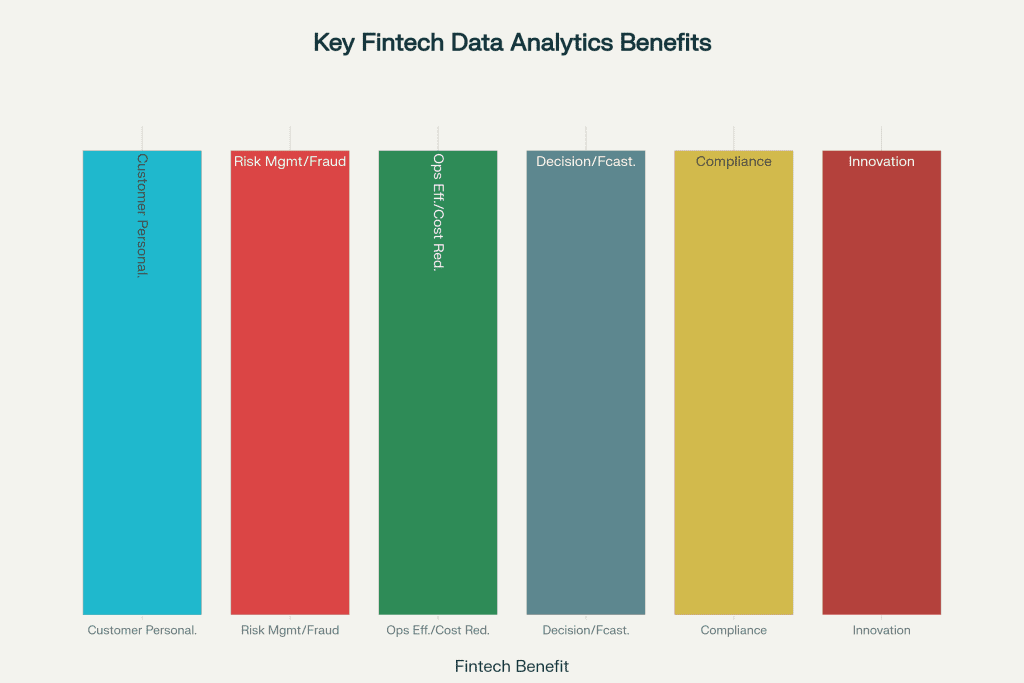

Key Benefits of Data Analytics in Fintech

-

Faster and smarter decision-making

-

Reduced fraud and operational risk

-

Improved loan and product personalization

-

Better regulatory reporting and auditability

-

Higher user retention and growth rates

Practical Example: AI-Powered Credit Scoring

A leading fintech lender integrates open banking data and transaction histories through a secure cloud pipeline. ML models analyze applicant financial footprints in real time, generating nuanced credit ratings that outperform legacy techniques—reducing default rates and improving financial inclusion.

Why Choose TechOTD for Fintech Data Analytics?

-

Deep expertise in cloud, AI, and secure web development for finance

-

Experience across banking, insurance, trading, and eCommerce verticals

-

End-to-end project delivery from strategy to support

-

Backed by glowing client testimonials—discover our services at TechOTD, About TechOTD, and Partner with Us.

Conclusion

Data analytics is the competitive edge that defines modern fintech. From collecting transaction data to deploying AI-driven models and visualizing actionable insights, each step unlocks new value and opportunity. If you’re looking to transform your fintech enterprise with next-level analytics, expert development, or custom AI, connect with TechOTD—and start building the future today.

FAQ

1. What is the primary value of data analytics in fintech?

It powers smarter decisions, reduces risk, and drives customer personalization and growth.

2. How do fintechs ensure data quality?

Through automated cleaning, transformation, real-time monitoring, and specialist support from partners like TechOTD.

3. What role does AI play in fintech analytics?

AI enables advanced use cases: predictive credit scoring, smart fraud detection, automated process optimization, and customer experience tailoring.

4. Is data analytics essential for compliance?

Absolutely. Analytics platforms facilitate real-time compliance checks, automated reporting, and full audit trails.

5. How can TechOTD help my fintech business?

By delivering secure, scalable, and innovative web, AI, and analytics solutions tailored for the financial services ecosystem—see our AI services and industry expertise