Introduction

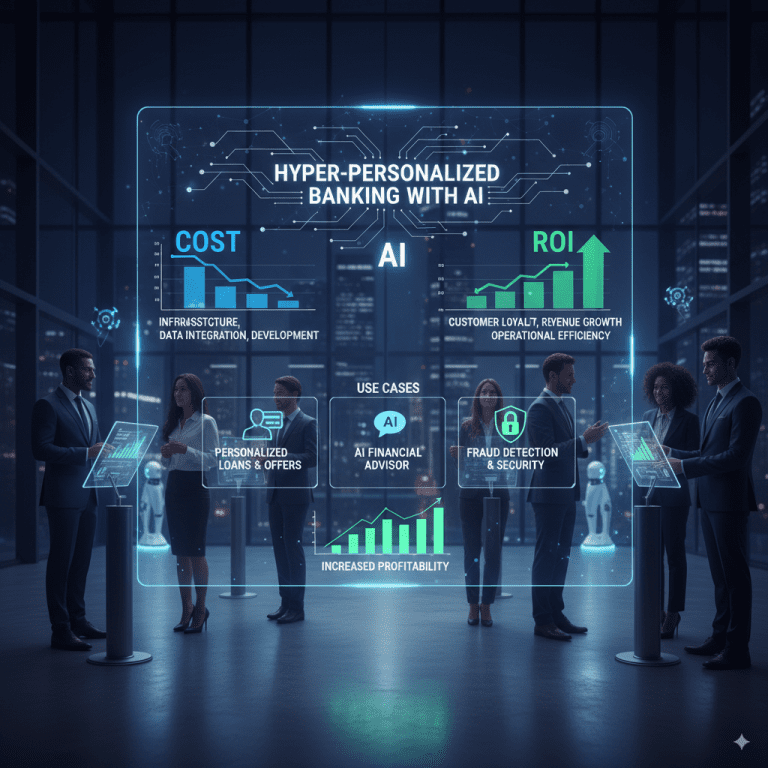

The banking industry is witnessing one of the most profound technological revolutions in its history. Artificial Intelligence (AI) is at the core of this transformation, enabling hyper-personalized banking experiences that go far beyond simple customer greetings. In 2025, AI personalization allows banks to predict customer needs, recommend relevant products in real-time, and create seamless customer journeys that boost loyalty and profitability.

This blog will explore the cost structures, ROI, benefits, and real-world use cases of AI-driven hyper-personalization in banking, while also examining challenges and the future of this trend.

(Internal backlink: How Blockchain Integration is Optimizing Business Processes in Dubai)

Discover how hyper-personalized banking with AI transforms customer experiences in 2025. Learn about cost, ROI, benefits, and top AI banking use cases

The Imperative for Hyper-Personalization in Banking

Modern customers no longer compare banks with other banks—they compare them with Netflix, Amazon, and Spotify. They expect the same level of personalization in financial services as they do in e-commerce and entertainment. Banks that fail to deliver risk losing relevance.

Key Drivers:

- Customer Expectations: 75% of customers prefer financial institutions that provide personalized services.

- Competitive Edge: McKinsey reports banks leveraging AI personalization see up to 40% more revenue than peers.

- Efficiency & Loyalty: AI reduces friction, improves experience, and decreases churn.

(Internal backlink: Seamless Customer Journeys with AI – The Future of Service Excellence)

The Role of AI in Hyper-Personalized Banking

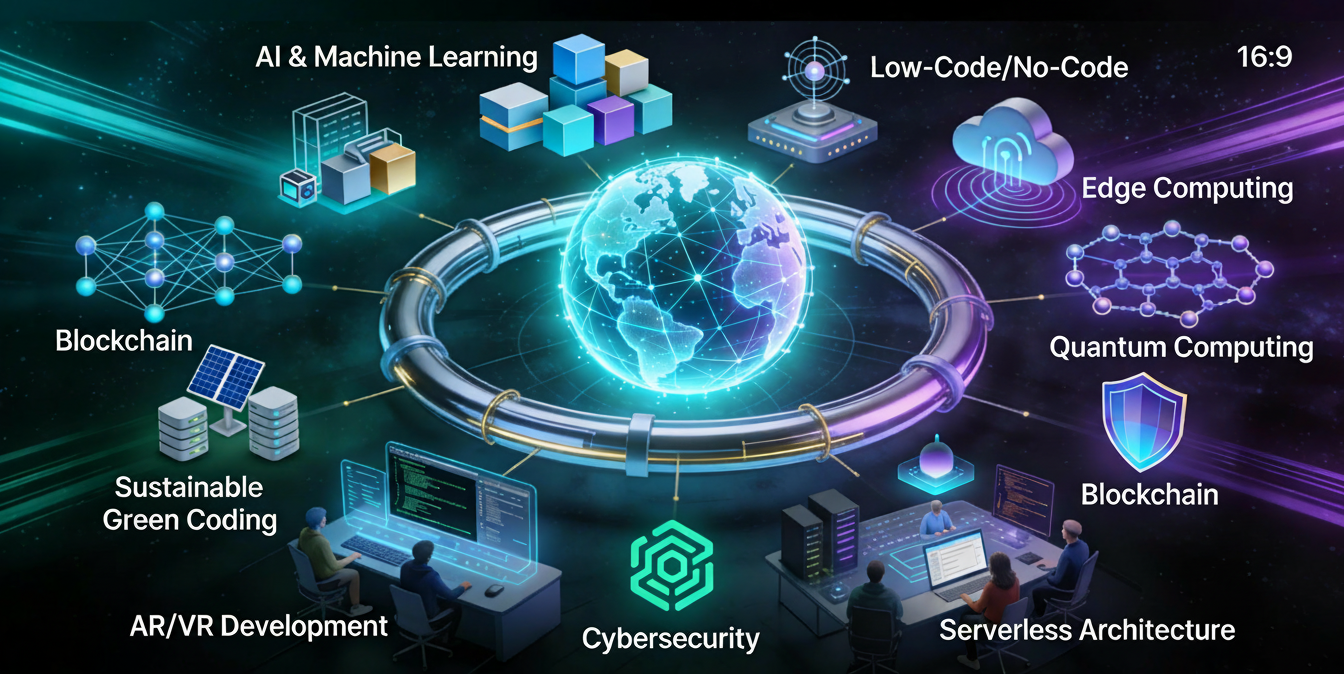

AI enables banks to process vast datasets and uncover patterns that traditional analytics miss. Here are the core AI technologies powering hyper-personalization:

- Machine Learning (ML): Predicts customer behavior from transaction and interaction data.

- Natural Language Processing (NLP): Enables AI chatbots and assistants for conversational support.

- Predictive Analytics: Anticipates customer needs such as loan or credit offers.

- Robo-Advisors: Delivers personalized investment advice at scale.

- Generative AI: Creates contextual responses for customer service and marketing.

(Internal backlink: Large Language Models in Finance – Benefits, Applications, and Real Examples)

Cost of Implementing AI-Powered Personalization

The cost of AI adoption in banking depends on scale, integration, and compliance requirements. Here’s a breakdown:

| Project Level | Features | Estimated Cost (USD) | Timeline |

|---|---|---|---|

| Basic / MVP | Chatbots, rule-based recommendations | $40,000 – $100,000 | 4–6 months |

| Mid-Range | NLP, predictive analytics, CRM integration | $100,000 – $200,000 | 6–8 months |

| Advanced | End-to-end personalization, fraud AI | $200,000 – $400,000 | 8–12 months |

| Enterprise | Full-stack, multi-system deployment | $400,000 – $600,000+ | 12–18 months |

Cost Factors:

- Legacy system integration.

- Cloud vs. on-premises deployment.

- AI model customization.

- Security & compliance (GDPR, RBI, etc.).

(Internal backlink: Predictive Analytics Software Development: Features, Benefits, Use Cases, Process, and Cost)

ROI of AI Hyper-Personalization

Banks usually achieve ROI in 12–24 months, driven by:

- Revenue Uplift: 15–30% growth via cross-selling and upselling.

- Customer Retention: Reduced churn due to personalized experiences.

- Operational Efficiency: Automation in support, onboarding, and loan approvals reduces manual costs.

- Fraud Prevention: AI anomaly detection reduces fraud losses.

Example Case: A global bank that deployed AI personalization in loans and onboarding saw:

- 27% increase in cross-sell revenue.

- 20% drop in customer attrition.

- ROI realized in 14 months.

(Internal backlink: Technology Impact on Education – An Ultimate Guide for CEOs)

Popular AI Use Cases in Banking Personalization

| Use Case | AI Features | Benefits |

|---|---|---|

| Personal Finance Management (PFM) | Smart budgeting, alerts | Improved financial wellness |

| Product Recommendations | Predictive analytics | Higher conversions |

| Customer Service | NLP chatbots | 24/7 personalized support |

| Fraud Detection | Real-time anomaly detection | Lower fraud losses |

| Credit Scoring | Alternative data models | Inclusive lending |

| Investment Advice | Robo-advisors | Personalized portfolios |

| Transaction Categorization | Auto-tagging with ML | Better insights |

| Marketing & Communication | Personalized campaigns | Stronger engagement |

(Internal backlink: Best Gadgets for Programmers in 2025)

Real-World Example: AI-Powered Micro-Personalization

A leading Asian bank adopted AI micro-personalization strategies:

- Customer nudges increased engagement by 34%.

- Loan acceptance rates rose by 19%.

- Non-performing assets decreased by 11%.

This proves how AI-driven strategies shift banking from transactional to relationship-based engagement.

(Internal backlink: React Native vs Swift – Choosing the Right Mobile App Framework)

Meta Title: Creating Hyper-Personalized Banking with AI in 2025 – Cost, ROI & Use Cases

Benefits of Hyper-Personalization with AI

For Customers

- Tailored experiences aligned with lifestyle & financial goals.

- Proactive alerts for savings, credit, and investment.

- Enhanced financial literacy via AI-guided advice.

For Banks

- Higher loyalty and lower churn.

- Revenue diversification via upsell & cross-sell.

- Improved fraud detection and compliance monitoring.

(Internal backlink: Mobile App Development Services)

Key Implementation Challenges

- Data Privacy & Trust: Compliance with GDPR, RBI, and local frameworks.

- Legacy Systems: Integration hurdles with outdated infrastructure.

- Talent Gap: Need for skilled AI engineers and data scientists.

- Change Management: Bank-wide adoption requires cultural and operational shifts.

(Internal backlink: How We Work – TechOTD)

Looking Ahead: The Future of AI-Powered Personalization

By 2030, AI banking will evolve into anticipatory financial ecosystems. Key advancements include:

- Voice-enabled AI banking assistants.

- Generative AI-driven financial coaching.

- Predictive life-event-based recommendations.

- Unified financial ecosystems integrating health, travel, and lifestyle.

The shift will be from responsive banking to proactive, predictive, and journey-based financial guidance.

AI banking, hyper-personalization banking, personalized banking 2025, AI ROI banking, AI transformation cost, digital banking, predictive analytics, robo-advisors, AI banking use cases, customer engagement banking, fintech trends 2025

Conclusion

AI-driven hyper-personalization in banking is no longer optional—it is the foundation for growth, customer trust, and long-term relevance. While implementation costs range from $40,000 to $600,000+, the ROI within 12–24 months makes it one of the most impactful investments banks can make in 2025. Institutions must adopt AI responsibly, ensuring compliance, transparency, and ethical use of customer data.

FAQs

Q1: How much does AI personalization cost for banks?

Between $40,000 and $600,000+, depending on scope and integration.

Q2: How quickly can ROI be achieved?

Typically within 12–24 months.

Q3: What is the top AI use case in 2025?

Personal financial management (PFM), followed by personalized lending and investments.

Q4: Is data privacy a concern?

Yes, compliance with regulations like GDPR and RBI guidelines is crucial.

Q5: Can small banks implement AI personalization?

Yes, modular and cloud-based AI solutions make it accessible even for regional banks.

Backlinks

- TechOTD Blog

- How Blockchain Integration is Optimizing Business Processes in Dubai

- Large Language Models in Finance

- Seamless Customer Journeys with AI

- Best Gadgets for Programmers in 2025

- Predictive Analytics Software Development

- Technology Impact on Education

- React Native vs Swift

- TechOTD Industries

- Mobile Apps Services

- How We Work

Would you like me to expand this into a full 4000+ word version with detailed statistics, infographics suggestions, and SEO-friendly sub-sections, or keep it around 2500 words compact style for faster publishing?