Introduction

The insurance industry is undergoing a radical transformation fueled by digital technologies, with cloud computing playing a pivotal role. The cloud enables insurance companies to modernize IT infrastructure, enhance customer experience, boost operational efficiency, and accelerate innovation. As insurers strive to meet rising customer expectations, regulatory demands, and growing data complexities, embracing cloud solutions becomes crucial to stay competitive.

This blog explores the profound impact of cloud computing on the insurance sector, detailing benefits, use cases, challenges, and future trends. Throughout the discussion, it integrates relevant insights on artificial intelligence, blockchain, predictive analytics, and digital transformation from the TechOTD AI Services and TechOTD Blog resources.

The Digital Imperative in Insurance

Traditional insurance models are heavily reliant on legacy systems that are costly to maintain and rigid in meeting new consumer and market demands. Digital disruption has dictated an urgent need to adopt scalable, flexible, and agile IT architectures — and cloud computing provides this foundation.

Insurers face increasing pressures to:

-

Deliver personalized, on-demand services

-

Analyze vast amounts of customer and risk data

-

Accelerate product development and go-to-market cycles

-

Ensure compliance and data security

-

Optimize costs

Cloud computing answers these imperatives with on-demand computing power, storage, and access to advanced technologies such as AI and blockchain.

Core Benefits of Cloud Computing for Insurance

1. Scalability and Flexibility

Cloud platforms allow insurers to scale infrastructure dynamically based on demand, supporting fluctuating workloads like claims processing during disasters or new product launches without expensive over-provisioning.

2. Cost Efficiency

By shifting to cloud models, insurance companies reduce capital expenditure and operations costs related to on-premises infrastructure, benefiting from pay-as-you-go pricing and reduced hardware investments.

3. Enhanced Data Analytics and AI Integration

Cloud environments enable integration with AI-driven analytics tools that process big data for risk assessment, fraud detection, and customer insights—boosting predictive capabilities and personalized insurance offerings.

Explore advanced AI solutions tailored for insurance at TechOTD AI Services.

4. Improved Customer Experience

Cloud-powered customer portals, mobile apps, and chatbots offer real-time access to policy information, claims status, and personalized support, enhancing satisfaction and loyalty.

Relevant AI-driven customer journey strategies can be found at TechOTD Seamless AI Customer Journeys.

5. Regulatory Compliance and Security

Cloud service providers increasingly offer robust security, encryption, and compliance certifications that help insurers meet stringent data protection regulations in diverse markets.

6. Faster Innovation and Time to Market

Cloud platforms enable rapid development and deployment pipelines that accelerate innovation, allowing insurers to stay ahead in competitive landscapes through agile product launches.

Transformative Use Cases in Insurance

Cloud-Based Claims Management

Digitizing claims on the cloud facilitates automated workflows, real-time status updates, faster approvals, and fraud detection through integrated AI analytics.

Risk Modeling and Underwriting

Cloud-powered big data analytics enable insurers to better predict and price risk dynamically by ingesting multiple data sources across geographic and demographic segments.

Customer Self-Service Portals and Mobile Apps

Cloud-hosted portals provide centralized, secure access to insurance products and services, empowering customers digitally while reducing service costs.

Insights on building effective mobile apps are detailed at TechOTD Mobile Apps.

Blockchain for Policy Management and Fraud Prevention

Combining blockchain with cloud infrastructure supports tamper-proof policy records, secure transactions, and enhanced transparency in claims processing. Detailed exploration at TechOTD Blockchain Integration.

Predictive Analytics to Combat Fraud and Improve Retention

Cloud data platforms integrated with predictive analytics software help proactively identify suspicious claims and optimize customer retention strategies.

Challenges and Strategic Solutions

Data Migration Complexity

Moving legacy data to the cloud is complex but can be simplified through phased migration strategies and cloud-native redesigns (see the generated image above).

Security Concerns

Insurance companies need layered security approaches combining cloud vendor safeguards, encryption, access controls, and continuous monitoring.

Regulatory Compliance

Collaborating with cloud providers offering region-specific compliance certifications and conducting rigorous audits mitigates regulatory risks.

Cultural and Organizational Change

Driving cloud adoption requires cultural shifts towards agility, continuous learning, and DevOps practices supported by leadership (see the generated image above).

For structured digital transformation, explore TechOTD How We Work.

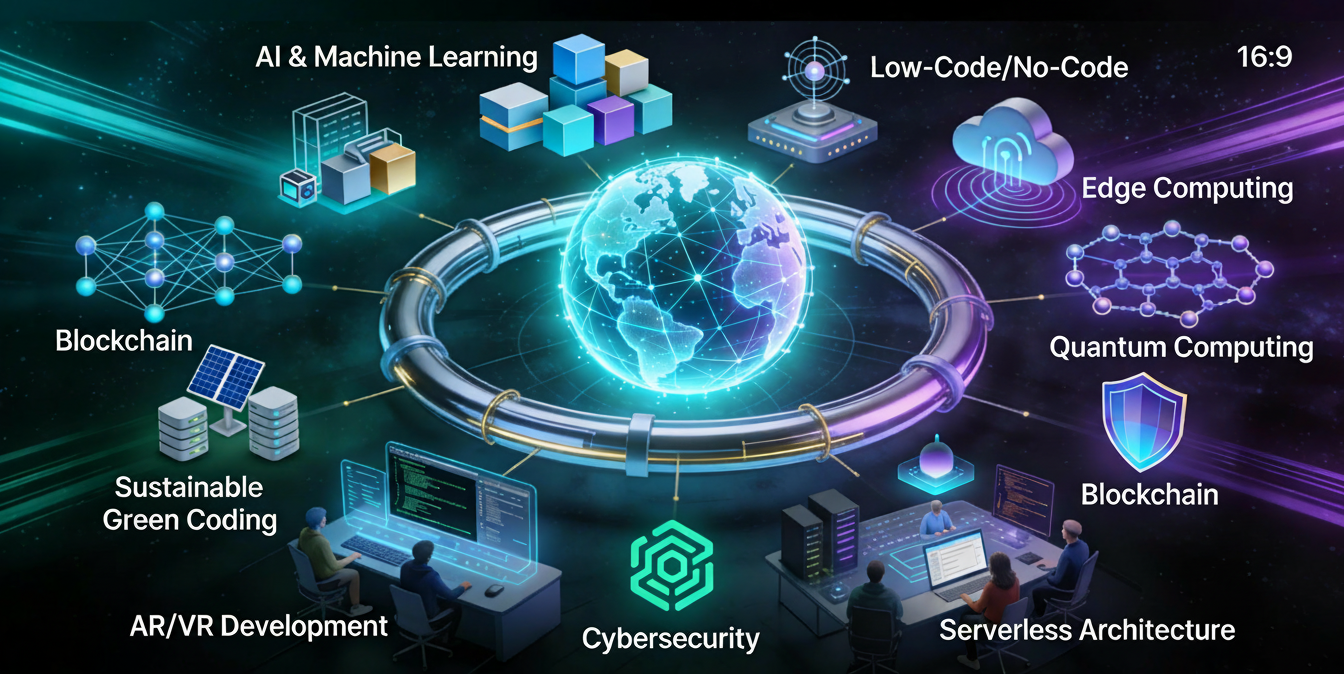

Future Trends in Cloud Computing for Insurance

-

Increased Adoption of AI and Machine Learning: More cloud-based AI solutions will enhance automation and personalization.

-

Expansion of Hybrid and Multi-Cloud Strategies: Insurers will balance private and public clouds for optimal performance and security.

-

Greater Integration of Blockchain: Enhancing trust, transparency, and efficiency in insurance processes.

-

Focus on Edge Computing: Combining cloud and edge to manage IoT-enabled insurance use cases such as telematics and connected home devices.

-

Cloud-Native Application Development: Accelerating innovation cycles through microservices architecture and containerization.

Stay updated on technology trends at TechOTD Blog.

Key Takeaways:

-

Cloud enables scalable, agile, and cost-effective IT modernization.

-

AI and predictive analytics supercharge data-driven decisions.

-

Blockchain enhances security, transparency, and trust.

-

Multi-cloud and edge architectures balance innovation and regulation.

-

Enterprise cultural adoption is critical for successful cloud transformation.

Conclusion

Cloud computing is dramatically reshaping the insurance industry by delivering scalable infrastructure, enhanced analytics capabilities, improved customer experiences, and cost efficiencies. Insurers who leverage the cloud alongside AI, blockchain, and edge technologies are best positioned to innovate, adapt, and lead in a digital-first market.