Introduction

The banking industry is rapidly embracing machine learning (ML) to enhance operational efficiency, manage risk, detect fraud, and deliver personalized customer experiences. As financial institutions face increasing competition, regulatory complexities, and evolving customer expectations, ML innovations are becoming central to banking digital transformation.

This comprehensive blog explores prominent use cases of machine learning in banking, its business impact, and the structured implementation process, supported by current insights and examples from leading institutions and fintech innovators.

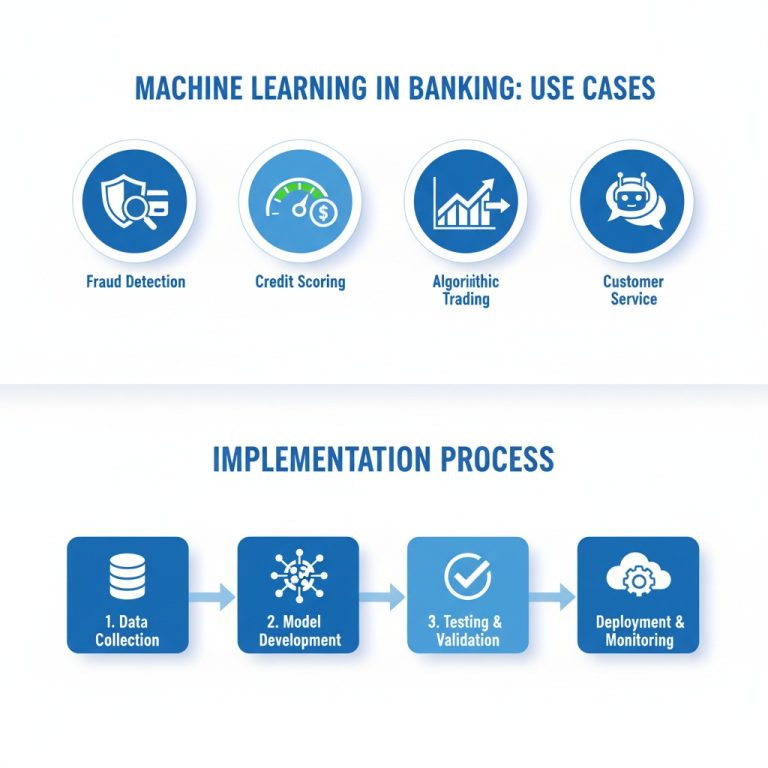

Key Use Cases of Machine Learning in Banking

1. Fraud Detection and Risk Management

Fraud detection is arguably the most critical application of ML in banking. Machine learning models analyze millions of transactions in real-time, identifying abnormal patterns and preventing unauthorized activities earlier and more accurately than traditional rule-based systems.

-

Behavioral analytics track anomalies like unusual transaction locations or atypical spending.

-

Models dynamically adapt to emerging fraud tactics without explicit reprogramming.

-

Banks like Citi use ML-driven anomaly detection for enhanced transaction security.

2. Personalized Customer Experiences

ML enables hyper-personalization by analyzing customer behavior, preferences, and financial histories to tailor products, services, and recommendations.

-

Robo-advisors provide customized investment advice based on risk tolerance.

-

Targeted financial products improve customer engagement and retention.

-

AI-driven virtual assistants offer real-time support and guidance addressing individual needs.

3. Process Automation and Operational Efficiency

ML automates back-office processes such as loan underwriting, document verification, compliance monitoring, and reconciliation, reducing human errors and increasing throughput.

-

Optical Character Recognition (OCR) converts handwritten documents for digital processing.

-

Robotic Process Automation (RPA) combined with ML streamlines regulatory compliance tasks.

-

Automation shortens loan approval cycles and improves customer onboarding.

4. Conversational Banking and Virtual Assistants

AI-powered chatbots and intelligent virtual assistants enhance customer service by providing 24/7 support for routine inquiries, transaction assistance, and fraud alerts.

-

Natural Language Processing (NLP) allows human-like interactions.

-

Automations reduce call center load and improve response times.

-

Virtual agents assist with bill payments, balance checks, and card controls.

5. Algorithmic Trading and Investment Analysis

ML models identify complex market trends using diverse datasets including news sentiment, social media, and historical prices, enabling data-driven trading strategies.

-

High-frequency trading bots optimize transactional timing and portfolio performance.

-

Predictive analytics improve risk forecasting and asset allocation.

-

Fintech firms leverage advanced ML to outperform traditional trading approaches.

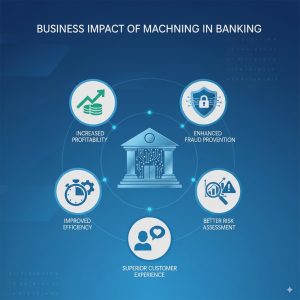

Business Impact of Machine Learning in Banking

-

Enhanced Security: ML reduces financial crime impact and regulatory penalties.

-

Improved Customer Loyalty: Personalized offerings increase satisfaction and retention.

-

Operational Cost Savings: Automation lowers manual processing costs.

-

Accelerated Innovation: Agile data-driven decision-making supports new product launches.

-

Increased Competitive Advantage: Banks implementing ML lead fintech innovation.

Explore advanced AI solutions fostering risk management and customer personalization at TechOTD AI Services.

Implementing Machine Learning in Banking: A Structured Process

Step 1: Business Needs Assessment

Identify critical banking processes that benefit from ML, such as fraud detection or customer segmentation. Define clear goals and success metrics aligned with strategic priorities.

Step 2: Data Collection and Evaluation

Gather relevant datasets spanning transactions, customer profiles, operational logs, and external market data. Data quality and completeness are paramount for effective ML models.

Step 3: Model Development and Training

Develop ML models tailored to use cases, including supervised classification for fraud, clustering for customer segmentation, and NLP for chatbots.

-

Choose algorithms suitable for the complexity and dataset size.

-

Employ techniques such as cross-validation and hyperparameter tuning.

-

Leverage cloud platforms to manage computational demands efficiently TechOTD Cloud Solutions.

Step 4: Model Testing and Validation

Rigorous testing using historical and simulated data ensures models meet accuracy, precision, and fairness criteria before deployment.

Step 5: Deployment and Integration

Deploy ML models into banking systems, integrated with transactional platforms, CRM, and compliance tools for streamlined workflows.

-

Use APIs for system communication.

-

Ensure real-time inference capability for critical applications.

Step 6: Monitoring and Maintenance

Continue monitoring model performance, retraining with new data and adapting to evolving patterns such as new fraud tactics or regulatory changes.

Challenges and Considerations

-

Data Privacy and Security: Ensuring compliance with regulations like GDPR while leveraging sensitive customer data.

-

Model Interpretability: Addressing regulatory needs for transparent, explainable AI decisions.

-

Legacy Systems Integration: Bridging newer ML systems with traditional banking infrastructure.

-

Organizational Readiness: Cultivating skilled teams and fostering ML adoption culture.

Learn about overcoming challenges with expert consulting at TechOTD How We Work.

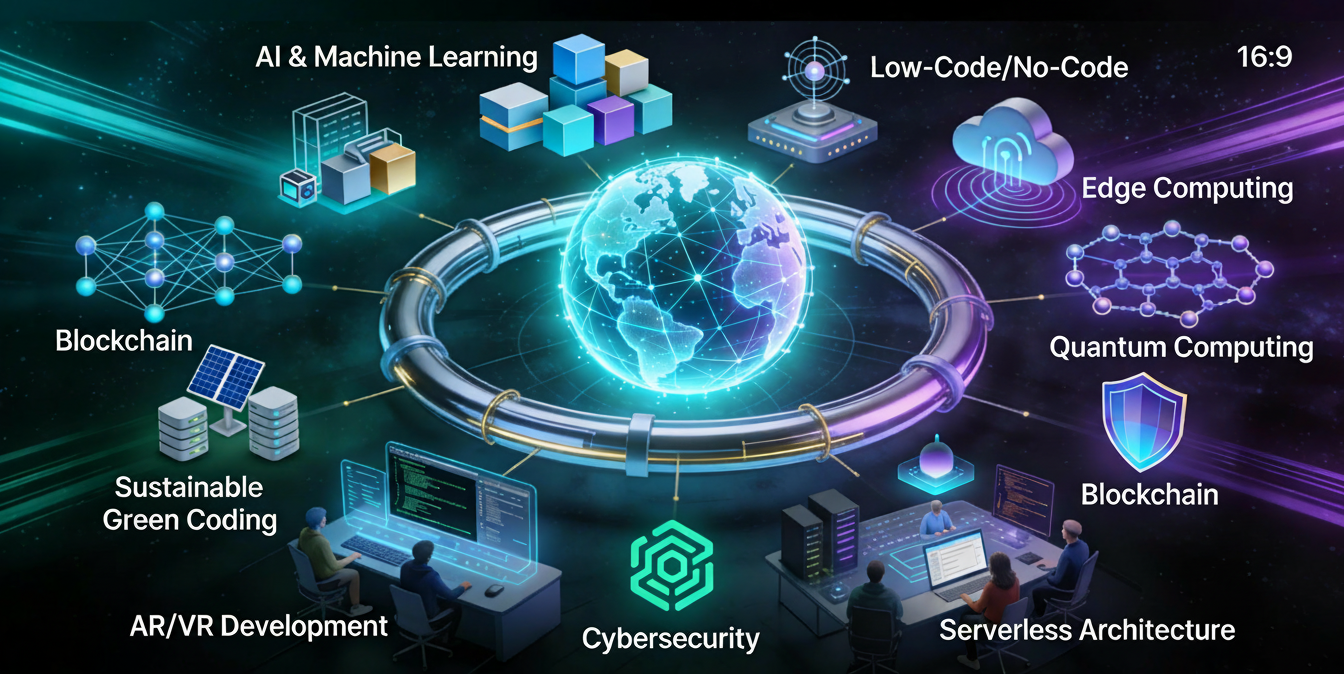

Future Trends in Machine Learning for Banking

-

Agentic AI: Autonomous AI agents driving higher-level decision making.

-

Federated Learning: Enhancing privacy by training models collaboratively without sharing raw data.

-

Continual Learning: Models that adapt continuously with minimal human intervention.

-

Cross-Industry Data Integration: Leveraging diverse data sources for holistic financial insights.

-

Enhanced NLP Capabilities: More sophisticated conversational banking and sentiment analysis.

Stay updated on AI and ML advances at the TechOTD Blog.

Conclusion

Machine learning is revolutionizing banking by enabling data-driven risk management, operational efficiency, and personalized customer journeys. Financial institutions that strategically implement ML processes and technologies stand poised to lead industry innovation, enhance profitability, and improve regulatory compliance.