Introduction

The financial technology (FinTech) sector is transforming at an unprecedented pace. From mobile payments and robo-advisors to digital lending and blockchain, FinTech companies are redefining how consumers and businesses interact with financial services. At the heart of this transformation lies data analytics. By leveraging big data, AI, and predictive analytics, FinTech enterprises are making smarter decisions, improving customer experiences, reducing risks, and driving innovation.

1. The Role of Data Analytics in FinTech

FinTech enterprises generate and process massive amounts of data daily, including transaction records, customer behavior, risk profiles, and market trends. Data analytics helps organizations:

-

Identify customer needs with precision.

-

Personalize financial products based on behavioral insights.

-

Mitigate financial fraud and cybersecurity risks.

-

Streamline operations and improve efficiency.

2. Key Applications of Data Analytics in FinTech

a. Personalized Financial Services

By analyzing spending habits, investment preferences, and credit histories, FinTech platforms can offer tailored services such as personalized investment portfolios, custom loan offers, and budgeting recommendations.

b. Fraud Detection and Risk Management

Advanced analytics, combined with AI algorithms, can quickly detect unusual transaction patterns or suspicious activities, minimizing fraud risks and ensuring compliance with regulatory frameworks.

c. Credit Scoring and Lending

Traditional credit scoring models are being replaced with advanced analytics that assess creditworthiness based on a broader set of data points, such as social behavior, digital footprints, and alternative credit indicators.

d. Predictive Analytics for Investments

FinTech firms use predictive models to forecast stock trends, cryptocurrency movements, and portfolio performance, empowering users to make informed investment decisions.

e. Customer Retention and Experience

Data-driven insights help organizations improve customer engagement through targeted marketing campaigns, loyalty programs, and 24/7 personalized financial advice.

3. Benefits of Data Analytics for FinTech Enterprises

-

Enhanced Decision Making: Real-time insights help businesses respond quickly to market changes.

-

Operational Efficiency: Automation and advanced analytics reduce costs and human error.

-

Improved Security: Detecting fraudulent activity before it impacts customers builds trust.

-

Competitive Edge: Firms leveraging analytics can outpace competitors with faster, smarter services.

4. Future Trends in FinTech Data Analytics

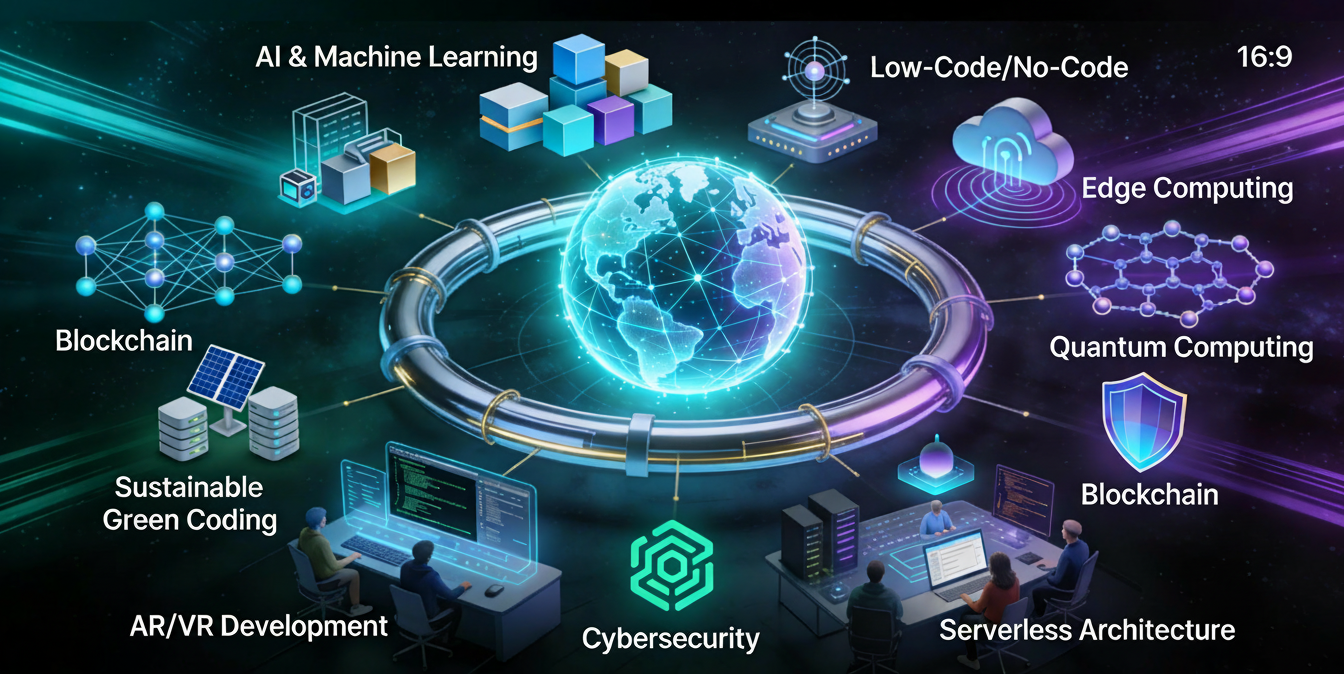

-

AI-Driven Automation: Integration of AI for faster data analysis and decision-making.

-

Blockchain Analytics: Ensuring secure and transparent financial transactions.

-

Advanced Predictive Modeling: Better risk management and investment strategies.

-

RegTech Solutions: Compliance analytics to handle evolving financial regulations effortlessly.

Conclusion

Data analytics is not just a supporting tool; it’s the driving force shaping the future of FinTech enterprises. From improving customer experiences to mitigating financial risks, its applications are limitless. Companies that embrace data analytics now will be well-positioned to lead the next wave of FinTech innovation.