Introduction

When most people hear “blockchain,” they immediately think of Bitcoin, Ethereum, and cryptocurrency speculation. While digital currencies introduced blockchain to the world, they represent merely the first application of a revolutionary technology with far-reaching implications across virtually every industry. Blockchain’s core characteristics—decentralization, immutability, transparency, and security—solve fundamental problems in trust, verification, and record-keeping that have plagued organizations for centuries. As we move beyond cryptocurrency hype cycles, blockchain is quietly transforming supply chains, healthcare systems, financial services, government operations, and creative industries.

Understanding Blockchain Technology

At its core, blockchain is a distributed ledger technology that records transactions across multiple computers in a way that makes records virtually impossible to alter retroactively. Unlike traditional databases controlled by single entities, blockchain distributes identical copies of the ledger across a network of participants, creating a shared source of truth that no single party controls.

Each “block” in the blockchain contains a batch of transactions, a timestamp, and a cryptographic hash linking it to the previous block, creating an unbroken chain extending back to the first block. This structure ensures that altering any historical transaction would require changing every subsequent block across the majority of network copies—a practically impossible task in well-designed systems.

Blockchain networks can be public (permissionless), where anyone can participate, read data, and submit transactions, or private (permissioned), where access is restricted to authorized participants. Public blockchains like Bitcoin prioritize decentralization and censorship resistance, while private blockchains trade some decentralization for privacy, speed, and regulatory compliance.

Smart contracts—self-executing programs that run on blockchain networks—extend blockchain beyond simple record-keeping. These programs automatically enforce agreements when predefined conditions are met, eliminating intermediaries and reducing the potential for disputes. Smart contracts enable complex multi-party workflows, automated compliance, and programmable money.

Consensus mechanisms determine how blockchain networks agree on the current state of the ledger. Bitcoin uses proof-of-work, where participants compete to solve computational puzzles. Ethereum has transitioned to proof-of-stake, where participants lock up cryptocurrency to validate transactions. Other mechanisms like practical Byzantine fault tolerance or proof-of-authority offer different trade-offs between decentralization, speed, and energy efficiency.

Supply Chain Revolution

Supply chain management represents one of blockchain’s most compelling real-world applications. Modern supply chains span continents, involve dozens of parties, and handle products passing through many hands before reaching consumers. Tracking products, verifying authenticity, ensuring quality standards, and managing documentation create enormous complexity and opportunities for fraud or error.

Blockchain creates transparent, immutable records of product journeys from origin to consumer. When a farmer harvests coffee beans, that transaction records on the blockchain. As beans move through processors, shippers, roasters, distributors, and retailers, each transfer adds a new block. Consumers can scan product codes to view complete histories, verifying origin claims and ethical sourcing.

Walmart has implemented blockchain for food safety, tracking produce from farms to stores. When contamination occurs, identifying affected products previously took days or weeks, requiring recalls of entire product categories. With blockchain tracking, Walmart can identify exact batches affected in seconds, reducing waste and protecting consumers more effectively.

The diamond industry uses blockchain to combat conflict diamonds and verify authenticity. Each diamond receives a unique identifier recorded on the blockchain along with characteristics, ownership history, and provenance documentation. This system helps ensure diamonds are ethically sourced and not synthetic imposters, protecting both consumers and legitimate miners.

Pharmaceutical companies are implementing blockchain to combat counterfeit drugs, a massive problem killing hundreds of thousands annually. By tracking medications from manufacturing through distribution to pharmacy, blockchain systems verify authenticity and detect diversion or counterfeiting. This transparency also helps manage recalls and expiration dates more effectively.

Automotive manufacturers use blockchain to track parts and components, ensuring quality and facilitating recalls. When defects are discovered, manufacturers can quickly identify which vehicles contain affected parts. The technology also helps prove maintenance history and verify odometer readings in used vehicle sales.

Healthcare Transformation

Healthcare systems struggle with fragmented medical records, privacy concerns, interoperability issues, and difficulty verifying credentials. Blockchain addresses these challenges while giving patients greater control over their health information.

Medical records stored on blockchain can be shared securely between providers while giving patients control over access permissions. When you visit a new doctor, they can request access to your medical history. You approve access through a secure interface, and the doctor retrieves encrypted records that only they can decrypt. This eliminates redundant tests, prevents dangerous drug interactions, and improves care quality.

Clinical trial data integrity represents another significant application. Pharmaceutical companies and researchers can timestamp and record trial protocols, data collection procedures, and results on blockchain, creating immutable audit trails. This transparency helps prevent data manipulation, builds trust in published results, and facilitates regulatory review.

Drug development and approval processes involve extensive documentation and multi-party coordination between researchers, manufacturers, regulators, and trial sites. Blockchain platforms can coordinate these workflows, ensure document authenticity, and create clear audit trails satisfying regulatory requirements.

Medical credential verification uses blockchain to combat fraudulent healthcare provider credentials. Professional licenses, educational degrees, board certifications, and training records recorded on blockchain can be instantly verified by hospitals, clinics, and patients. This reduces administrative burden and prevents unqualified individuals from practicing medicine.

Medical device tracking and maintenance leverages blockchain to record device histories, maintenance schedules, and safety alerts. This proves particularly valuable for implantable devices, where tracking individual units through manufacture, implantation, and patient monitoring ensures quality and facilitates recalls when necessary.

Financial Services Innovation

While cryptocurrency dominates blockchain headlines, financial institutions are implementing blockchain for traditional banking operations. The technology promises faster settlements, reduced costs, improved transparency, and new financial products.

Cross-border payments using blockchain can settle in minutes rather than days, with lower fees than traditional wire transfers or remittance services. Banks and payment processors are developing blockchain-based systems enabling real-time international payments, particularly valuable for remittances to developing countries where traditional services charge exorbitant fees.

Securities trading and settlement traditionally involves multiple intermediaries and takes days to finalize. Blockchain-based systems can settle trades instantly while maintaining regulatory compliance and audit trails. The Australian Securities Exchange is replacing its clearing and settlement system with blockchain infrastructure.

Trade finance, which involves letters of credit, bills of lading, and complex documentation for international commerce, benefits enormously from blockchain. Multiple parties including importers, exporters, banks, customs agencies, and shippers can all access shared, tamper-proof records, reducing fraud, paperwork, and delays.

Syndicated loans, where multiple lenders provide portions of large loans, involve complex administration and information sharing. Blockchain platforms coordinate lenders, automate interest calculations and distributions, and maintain transparent records of ownership interests and payments.

Digital identity and know-your-customer (KYC) compliance create significant costs and friction in financial services. Blockchain-based digital identity systems could allow customers to verify their identity once, then share verified credentials with multiple institutions, reducing redundant verification processes while maintaining privacy.

Government and Public Services

Government agencies worldwide are exploring blockchain for voting systems, land registries, identity management, and public records. The technology’s transparency and immutability appeal to efforts combating corruption and improving public services.

Voting systems using blockchain could increase election security, transparency, and accessibility. Voters could cast ballots remotely while cryptographic verification ensures each person votes once and results cannot be manipulated. Estonia has pioneered digital governance, including blockchain elements in various systems, though widespread blockchain voting faces technical and political challenges.

Land title registries in many countries suffer from corruption, disputes, and inefficiency. Blockchain-based land registries create immutable ownership records, streamlining transfers and reducing disputes. Countries including Georgia, Sweden, and Honduras have piloted blockchain land registries with varying results.

Government identity systems could leverage blockchain for secure, portable digital identities. Citizens could control their identity information, selectively sharing verified attributes (age, residence, citizenship) with government agencies or private companies without revealing unnecessary personal details.

Business licensing and permits involve multiple agencies, extensive documentation, and opportunities for corruption or delay. Blockchain-based systems coordinate multi-agency approvals, maintain transparent records, and automate compliance monitoring.

Public procurement processes benefit from blockchain’s transparency. Recording contracts, bids, and payments on blockchain creates audit trails helping detect corruption and ensure competitive processes. This transparency particularly benefits developing countries combating endemic corruption.

Intellectual Property and Digital Rights

Creators, artists, and inventors face challenges protecting intellectual property, proving ownership, and receiving fair compensation. Blockchain offers solutions through transparent rights management and automated royalty distribution.

Copyright registration using blockchain allows creators to timestamp and prove ownership of creative works. Musicians, writers, photographers, and other artists can register works on blockchain, creating indisputable proof of creation dates and ownership. This evidence proves valuable in infringement disputes.

Digital rights management and licensing can be automated through smart contracts. When someone purchases music, images, or other digital content, smart contracts automatically distribute payments to creators, rights holders, and intermediaries according to predetermined agreements. This transparency and automation reduce disputes and ensure creators receive fair compensation.

Patent application processes could use blockchain to timestamp inventions, maintaining clear priority dates and preventing patent theft. The patent examination process itself could leverage blockchain for secure, efficient information sharing between inventors, patent offices, and examiners.

Non-fungible tokens (NFTs) represent ownership of unique digital or physical items using blockchain. While speculative NFT trading dominated headlines, the underlying technology enables artists to sell digital works, maintain royalty rights on secondary sales, and prove authenticity—capabilities impossible in traditional digital markets.

Real Estate Transformation

Real estate transactions involve extensive paperwork, multiple intermediaries, and significant time and cost. Blockchain streamlines these processes while reducing fraud and increasing transparency.

Property title management using blockchain creates clear, immutable ownership records. Title searches that currently take days or weeks and cost hundreds or thousands of dollars could become instant and virtually free. Title insurance, which protects against title defects, might become unnecessary with reliable blockchain records.

Transaction processes can be automated through smart contracts. When conditions are met—financing approved, inspections completed, documents signed—smart contracts automatically transfer ownership and distribute funds to sellers, agents, and lenders. This automation reduces closing times from weeks to hours while lowering costs.

Fractional ownership models enabled by blockchain make real estate investment more accessible. Properties can be tokenized, with ownership divided into shares tradeable on blockchain platforms. Investors can buy small stakes in properties, receiving proportional rental income and appreciation, lowering barriers to real estate investment.

Property management and maintenance records stored on blockchain create comprehensive property histories. Maintenance work, renovations, inspections, and repairs all record on blockchain, providing transparency for buyers and potentially increasing property values by proving proper maintenance.

Challenges and Limitations

Despite promising applications, blockchain faces significant challenges limiting widespread adoption. Scalability remains problematic—public blockchains process far fewer transactions per second than traditional databases. Solutions like layer-2 protocols and sharding are being developed but add complexity.

Energy consumption, particularly for proof-of-work blockchains, raises sustainability concerns. Bitcoin mining consumes as much electricity as some countries. While proof-of-stake and other mechanisms dramatically reduce energy use, public perception of blockchain as environmentally harmful persists.

Regulatory uncertainty creates hesitation around blockchain adoption. Governments worldwide are still determining how to regulate blockchain applications, particularly in finance and healthcare. This uncertainty makes organizations cautious about major blockchain investments.

Interoperability between different blockchain platforms remains limited. Moving assets or data between blockchains requires complex bridges or centralized intermediaries, undermining some blockchain benefits. Cross-chain standards and protocols are developing but remain immature.

User experience often requires technical knowledge that average users lack. Managing private keys, understanding transaction fees, and navigating blockchain interfaces present barriers to mainstream adoption. Improved user interfaces and custodial solutions help but introduce centralization and vulnerability.

Integration with existing systems poses technical challenges. Organizations have extensive legacy infrastructure that must interface with blockchain applications. This integration requires significant development effort and potentially system redesign.

The Future of Blockchain

As technology matures and solutions to current limitations emerge, blockchain adoption will likely accelerate across industries. Hybrid models combining blockchain’s benefits with traditional database efficiency may prove most practical for many applications.

Central bank digital currencies (CBDCs) represent major blockchain developments. Dozens of countries are exploring or piloting digital versions of their currencies using blockchain or similar technologies. CBDCs could transform monetary policy, payment systems, and financial inclusion.

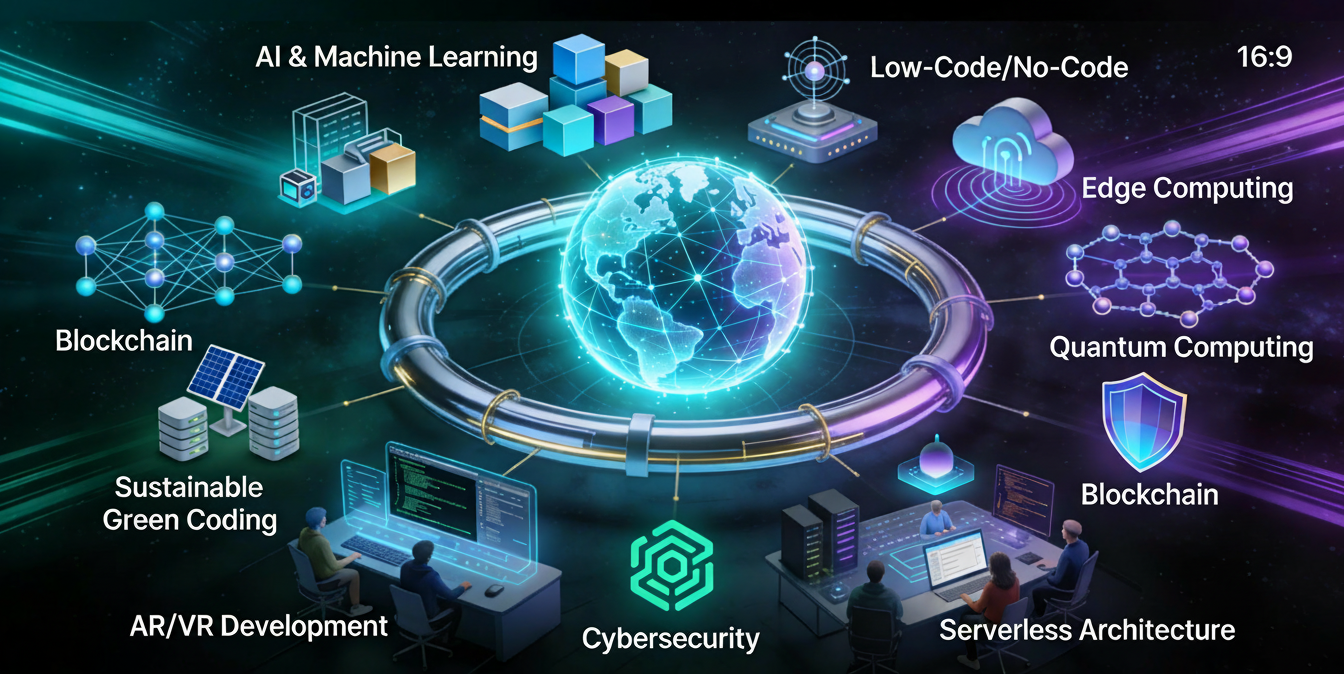

Integration with other emerging technologies will amplify blockchain’s impact. Combining blockchain with the Internet of Things creates secure, automated systems for supply chains, smart homes, and industrial applications. Artificial intelligence can analyze blockchain data, optimize smart contracts, and enhance security.

Industry-specific blockchain platforms are emerging, optimized for particular use cases rather than serving as general-purpose platforms. Healthcare blockchains, supply chain blockchains, and financial services blockchains can optimize for industry-specific requirements.

Conclusion

Blockchain technology extends far beyond cryptocurrency speculation into practical applications solving real business problems. From ensuring food safety to protecting medical records, streamlining real estate transactions to combating counterfeit products, blockchain creates value through transparency, security, and automation.

While challenges remain and hype often exceeds reality, steady progress continues. Organizations implementing blockchain today gain experience with transformative technology that will increasingly shape future business and society. Understanding blockchain’s potential and limitations helps individuals and organizations prepare for a future where distributed ledger technology is as fundamental as databases and the internet.

The blockchain revolution won’t happen overnight, but it is happening. Those who understand and adapt to this technology will shape and benefit from the decentralized, transparent future being built block by block.

FAQs

Q1: Is blockchain the same as Bitcoin? A: No, blockchain is the underlying technology, while Bitcoin is just one application of blockchain. Think of blockchain as the internet and Bitcoin as email—email runs on the internet, but the internet enables many other applications. Blockchain can be used for supply chain tracking, medical records, voting systems, and countless other applications beyond cryptocurrency.

Q2: Can blockchain be hacked or altered? A: While no system is completely unhackable, properly implemented blockchain is extremely secure and resistant to alteration. Changing historical records would require controlling the majority of network computing power and altering records across thousands of computers simultaneously—practically impossible for established networks. However, vulnerabilities can exist in smart contracts, wallet software, and exchanges built on top of blockchain.

Q3: Why would businesses use blockchain instead of regular databases? A: Blockchain provides advantages when multiple parties need to share data without trusting a central authority. It ensures data integrity, creates transparent audit trails, enables automation through smart contracts, and prevents single points of failure. However, traditional databases remain better for many applications where centralized control is acceptable and higher performance is needed.

Q4: Does using blockchain require cryptocurrency? A: Not necessarily. Private or permissioned blockchains used by enterprises often don’t involve cryptocurrency. These systems use blockchain technology for its record-keeping and verification benefits without public trading of tokens. Public blockchains typically use cryptocurrency for transaction fees and security incentives, but many business applications don’t require users to hold or trade cryptocurrency.

Q5: How long until blockchain becomes mainstream? A: Blockchain adoption varies by industry and application. Some sectors like financial services and supply chain are already implementing blockchain solutions at scale. Others face regulatory or technical hurdles that may take 5-10 years to resolve. Widespread consumer-facing blockchain applications likely remain several years away, though behind-the-scenes business applications are growing steadily. The technology is evolving from hype to practical utility, but mainstream adoption will be gradual rather than sudden.