Introduction

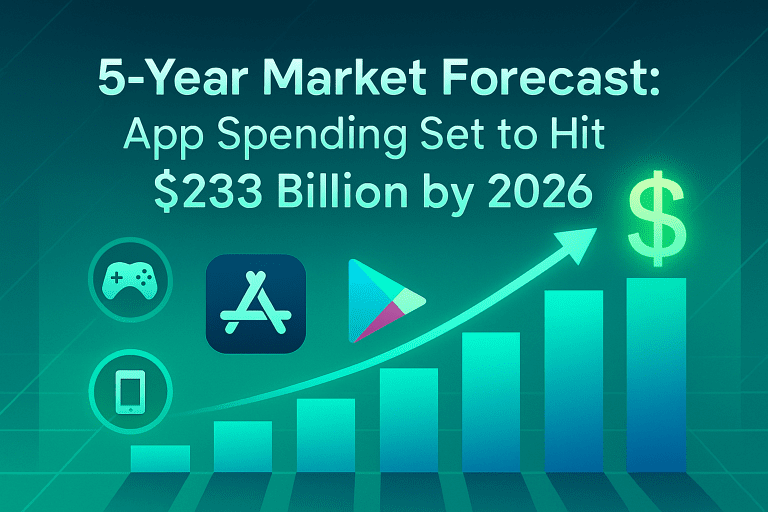

As the digital economy continues its explosive growth, mobile app spending is breaking new records. By 2026, global expenditures in mobile apps—including premium downloads, in-app purchases, and subscriptions—are forecasted to reach an unprecedented $233 billion. For businesses, developers, and tech leaders, understanding this evolving landscape is essential to maximize growth and make future-ready decisions. In this blog, we analyze the market’s trajectory, highlight key growth drivers, and provide actionable insights—with direct links to TechOTD’s expert IT, AI, and development services to help you capitalize on these booming trends.

-

2021–2026 App Economy Surge

-

Global app spend is projected to hit $233 billion by 2026—a 77% leap from $132 billion in 2021.

-

This growth is powered by the ongoing digital transformation seen across industries and regions.

-

-

Platform Breakdown

-

Apple App Store: Anticipated to reach $161 billion in revenue with a CAGR of 13.7%.

-

Google Play Store: Forecasted to grow to $72 billion, with an 8.9% CAGR.

-

-

Regional Insights

-

United States: Leads global growth, forecasted at $86 billion (16.5% CAGR).

-

Asia-Pacific: Remains the largest market for first-time downloads, fueled by rising smartphone penetration and affordable connectivity.

-

-

Emerging Categories

-

Non-gaming app categories such as entertainment, productivity, and healthcare are now rivaling gaming, with non-gaming apps expected to comprise 57% of iOS revenue by 2026.

-

Top Factors Driving Market Growth

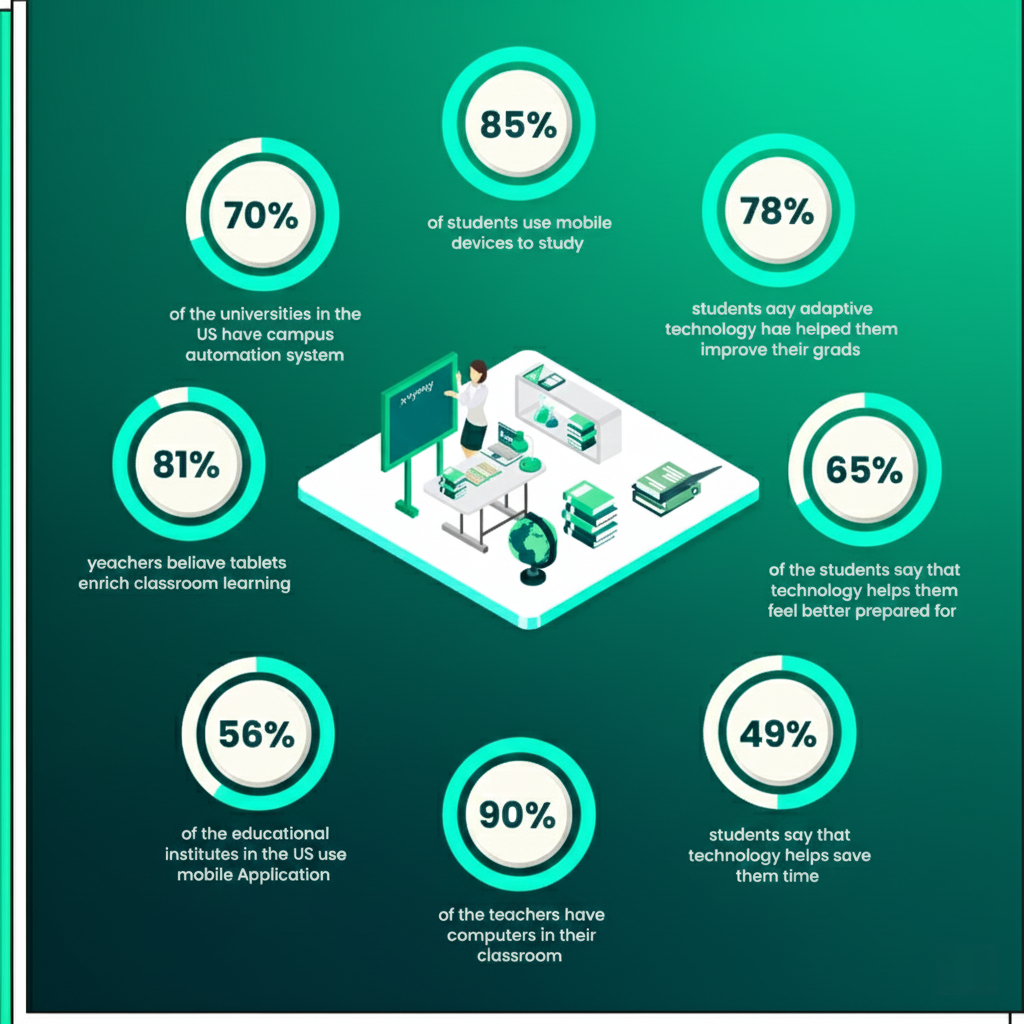

1. Digital Acceleration Post-2020

-

Pandemic-driven habits (remote work, remote learning, online buying) have become permanent, boosting demand for both consumer and enterprise apps.

-

Brands are expanding digital offerings to stay competitive—see how digital solutions can modernize your workflows at TechOTD.

2. Rise of Non-Gaming App Revenue

-

Beyond mobile games, categories like social networking, streaming, business, and eCommerce apps are seeing record growth.

-

Leverage industry-focused app innovation and strategy through TechOTD’s AI Solutions and Industry Services.

3. Recurring Revenue Models (Subscriptions)

-

Subscription-based revenue is dominating app monetization, leading to higher lifetime value per user.

-

Ensure your app’s backend supports scalable infrastructure by partnering with TechOTD’s Web & App Development Team.

4. Continued First-Time Downloads

-

App downloads are projected to hit 181 billion in 2026, led by emerging markets and expanding internet access.

-

Businesses must optimize onboarding and long-term retention, strategies that TechOTD can help implement for both consumer and B2B apps.

Actionable Insights for Business and Developers

-

Invest in Non-Gaming Vertical Apps

As user preferences diversify, now’s the time to innovate with apps in finance, health, education, and productivity. -

Capitalize on Subscriptions & Cloud Integration

Build for recurring revenue and global scale. TechOTD’s cloud and AI expertise ensures seamless growth and personalized experiences. -

Optimize for Regional Growth Hotspots

Adapt user journeys and payment strategies for growth markets like Asia-Pacific and North America. -

Future-Proof with AI and Analytics

Data-driven insights and machine learning will be at the heart of profitable apps—explore custom AI integration at TechOTD AI. -

Partner for End-to-End Excellence

From ideation to deployment and lifecycle support, trust TechOTD for web, mobile, and enterprise application success.

Conclusion

Mobile app spending is on track to redefine the global digital economy, soaring toward $233 billion in just five years. For brands, startups, and enterprises, opportunity lies in pairing innovative products with robust development and growth strategies. As digital transformation accelerates worldwide, let your app leverage the tools, partnerships, and expertise of leaders like TechOTD—and secure your place at the frontier of the $233 billion app economy.

FAQ

1. What is the projected global app spending in 2026?

Global app expenditure is forecasted to reach $233 billion by 2026, led by strong growth in both iOS and Android markets.

2. Which platform will be the biggest revenue driver?

The Apple App Store will continue to lead in overall revenue, while Google Play drives a majority of downloads from emerging regions.

3. Will non-gaming apps overtake games in revenue share?

Yes, on the App Store, non-gaming apps are expected to comprise 57% of total revenue by 2026.

4. What is the CAGR for overall global app spending?

The compound annual growth rate is predicted at 12% from 2021 to 2026.

5. How can I position my app for success in this market?

Focus on solving real problems, leverage cloud and AI, invest in scalable infrastructure, and partner with comprehensive IT experts like TechOTD.